18 May, 2025

Bitcoin mining gets tougher as difficulty surges and hash rate drops

On Saturday, at block height 897,120, Bitcoin's mining difficulty increased by 2.13% to 121.66 trillion, slightly increasing the computational challenge required to discover new blocks.

Bitcoin Mining Difficulty Breaks 121 Trillion

Miners now face a slightly increased difficulty to solve blocks, and this adjustment makes the process 2.13% harder. Although the current difficulty is 121.66 trillion, it is still not as high as the highest difficulty after block 893,088.

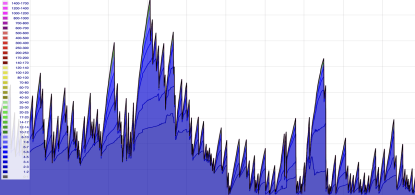

So far in 2025, the network has experienced six upward adjustments, totaling a gain of 13.83%, and three downward adjustments, totaling a decrease of 8.61%. Meanwhile, Bitcoin’s total processing power has decreased from a peak of 929 exahash per second (EH/s) to 848.53 EH/s, based on the seven-day simple moving average (SMA) tracked by hashrateindex.com — reflecting a contraction of more than 80 EH/s.

Despite the decline in raw hash rate, miners have benefited from stronger profitability as the Bitcoin price has remained above $100,000 for ten consecutive days. About a month ago, the hash price — the expected revenue for operating 1 petahash per second (PH/s) per day — hovered around $44.29 PH/s. As of today, that number has improved significantly and is now $54.93 PH/s.

Bitcoin’s difficulty adjustments and hash rate fluctuations provide nuanced insights into the evolving dynamics between miner incentives and network resilience. As economic conditions, energy costs, and price trends continue to influence mining economics, the delicate balance between participation and profitability will remain a key narrative.